When we started PearlMutual Consulting Ltd., it became apparent very quickly that the primary factor behind the operational challenges faced by our clients was access to finance.

And so began our story with capital raising. Acting as financial advisors linking up SMEs to funding sources is not without roadblocks. Unlike established businesses, they lack the typical forms of collateral nor the transactional history required by traditional financial institutions.

Two years ago, we started designing an innovative solution. With our years of experience as financial consultants, we knew that our solution had to go beyond providing access to funding. We had to create a structure that ensured that the funding provided is used efficiently, creating sustainable growth for our SMEs.

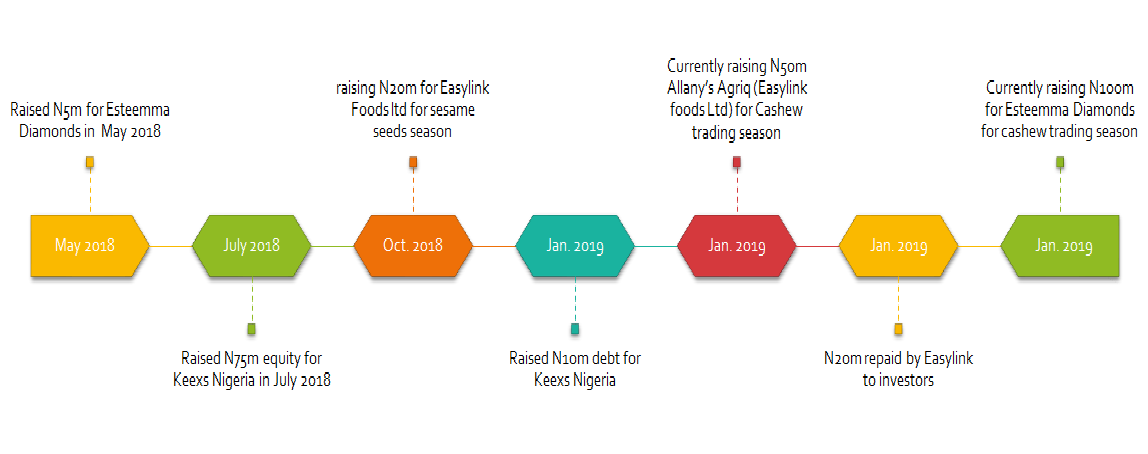

Our solution is BridgeAngels. A capital raising product, built on the principles of business incubation, targeted at providing Nigerian SMEs with project, trade and working capital. Our FundOne sources funds from high net worth individuals using debt or equity investment models.

In two years, we have incubated 9 SMEs operating across five different industries. Together, we have created significant measurable social impact in more than four Nigerian communities.

The goals of BridgeAngels remain the same, to feed the nation, grow Nigeria’s export revenue, increase her export influence, and reduce economic disparity.

We continue to build upon our foundation by innovating and creating new solutions that will help create sustainable growth for businesses.

We may not be able to fund every Nigerian SME today. However, with our free quarterly SME clinic, we hope to provide SME owners and managers with critical foundational technical knowledge and a professional ecosystem needed to build long-lasting businesses.

We are grateful for two years of BridgeAngels, and we look forward to many more years.

Through strategic partnerships with our clients, business challenges become business performance enablers