Week 45, Year 2022

Date published: 7th November 2022

According to the 2023 Appropriation Bill, Nigeria plans to spend 20.51 trillion Naira in 2023.

Key sectors such as education, health, agriculture, and power will make up 4.87%, 5.03%, 1.08%, and 1.36% of the budget, respectively.

Exactly 13.09% of the budget will go towards security. This includes total police expenditure, defense, the department of State Security, the Nigeria Security & Civil Defense Corps, office of the National Security Adviser, as well as operations, pension, and health insurance of the military.

Nigeria plans to fund this budget through revenue (47.42%), loans (51.57%), and asset sales/privatization (1.01%.)

Week 42, Year 2022

Date published: 21st October 2022

Week 35, Year 2022

Date published: 7th September 2022

Download the Full Insight Article:

Week 33, Year 2022

Date published: 18th August 2022

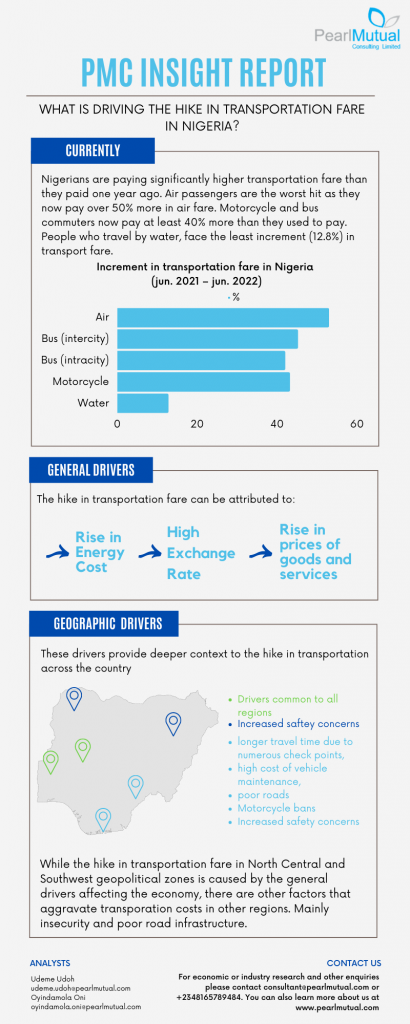

Summary: Residents in Nigeria now pay significantly higher transportation fare than they paid one year ago. Air passengers are the worst hit as they now pay over 50% more in air fare. Motorcycle and Bus commuters now pay at least 40% more than used to pay. People who travel by water, face the least increment (12.8%) in transport fare. The hike in transportation fare can be attributed to the rise in energy cost, high exchange rate, and the stimulus effect of the general rise in prices of goods and services.

Week 30, Year 2022

Date published: 27th July 2022

Summary: As of June 2022, Nigerians are paying over double what they paid last year for energy. Between June 2021 and June 2022, the price of kerosene has increased by 105.70%. Similarly, Gas has increased from NGN 413.74 per kilogram to NGN 843.68, representing a 103.92% increase. More severely, the price of Diesel has increased by 202.67% in the same period. Petrol experienced a relatively marginal increment of 6.21%. The increase in energy costs has significantly reduced the purchasing power of Nigerians, resulting in an overall reduction in the standard of living

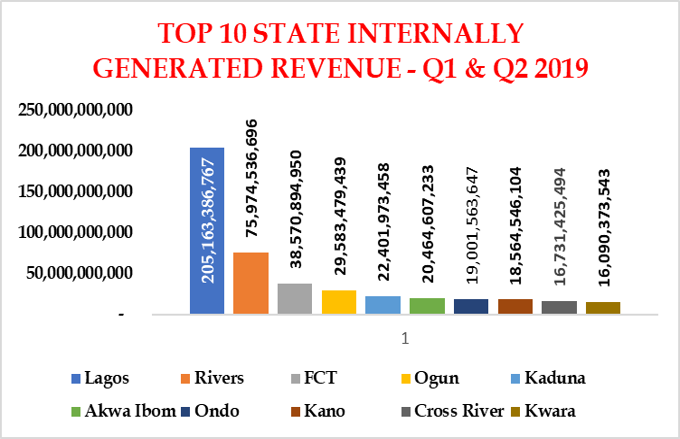

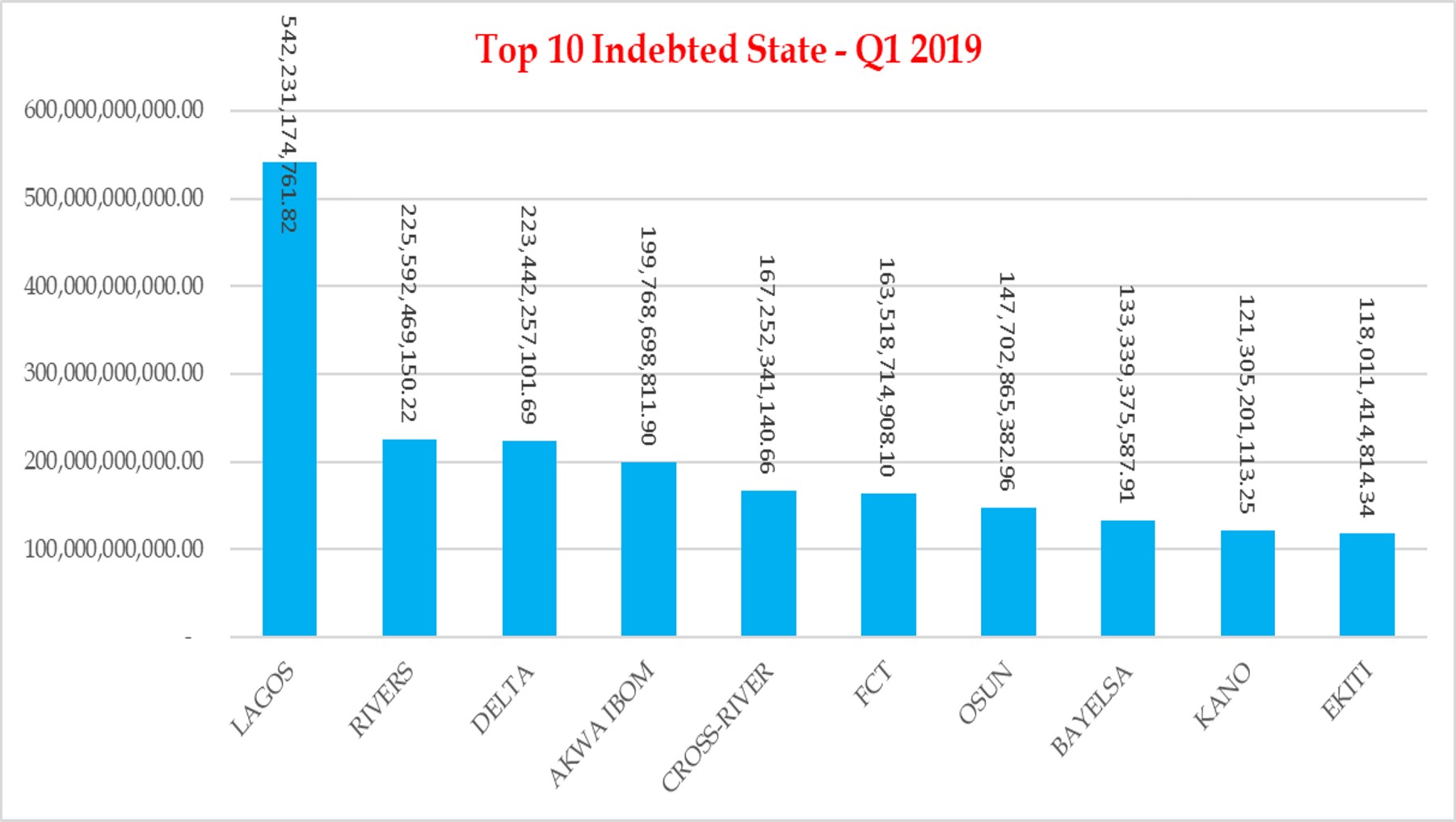

INTERNALLY GENERATED REVENUE (Q1 & Q2 2019) V DOMESTIC DEBT FOR TOP 10 STATES

- According to the National Bureau of Statistics, Internally Generated Revenue at State level for Q1 & Q2 2019 for the 36 states and FCT IGR figure stands at N691.11bn in H1 2019 compared to N596.91bn recorded in H2 2018. This indicates a positive growth of 15.78%.

- Thirty-one (31) states and the FCT recorded growth in IGR while five (5) states recorded decline in IGR at the end of H1 2019.

From the data obtained, Lagos topped as the State with the highest IGR.

- However, the value of foreign debt stands at $4.23bn while domestic debt hits N3.85 trillion at the end of the year 2018 respectively.

- In addition, Lagos state maintains its position as the most indebted state in Nigeria.

From the data obtained, Lagos topped as the State with the highest IGR.

.